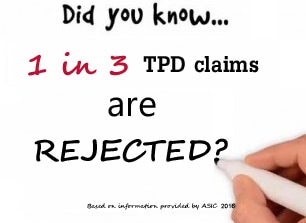

An average person pays tens of thousands of dollars for insurance throughout their employment and working life. However, when injury, sickness or tragedy strikes, many find themselves in financial stress because their TPD claim is rejected by their insurer.

Over 16% of TPD claims are rejected

This month, when the Australian Securities and Investments Commission (ASIC) released their report, we found out that over 16% of TPD claims are rejected and some insurers even recorded rejection rates as high as 37%. This insurer has since been reported in the Weekend Australian to be owned by Westpac. These figures are extremely concerning.

There was significant media coverage earlier this year about CommInsure, Commonwealth Bank’s life insurance arm. As a result ASIC was asked to review the life insurance sector. ASIC’s findings brought to light that many claims were rejected based on technicalities and decisions were not made ‘in good faith’ but strictly in accordance with the policy which might contain inaccurate or outdated medical definitions. Their recommendations included increasing transparency and providing consumers with greater knowledge when signing up for a life insurance policy. In addition, insurers with above average rates of denied claims will be followed up for further investigation.

To address these requirements, the Financial Services Council, who represents insurers, introduced a life insurance code of conduct. However this code fails to bind trustees of superannuation funds whose policies make up the majority of the market. So whilst it is a step in the right direction, real changes are not expected to occur until the Federal Government steps in and tightens up this code to protect consumers.

We can help

If you believe that you are entitled to any form of superannuation, insurance or disability payment call 13 43 63 to speak with one of our expert superannuation lawyers in Queensland. Our offices are in Brisbane, Logan, North Lakes, Ipswich, Toowoomba, Gold Coast, Sunshine Coast and Cairns.